![[SBS Good Partner] ‘New Start’ Who is the first client that Jang Nara faces?](https://kroamer.com/upload/trending/thumb-T9B1726187910749_600x2185.jpg)

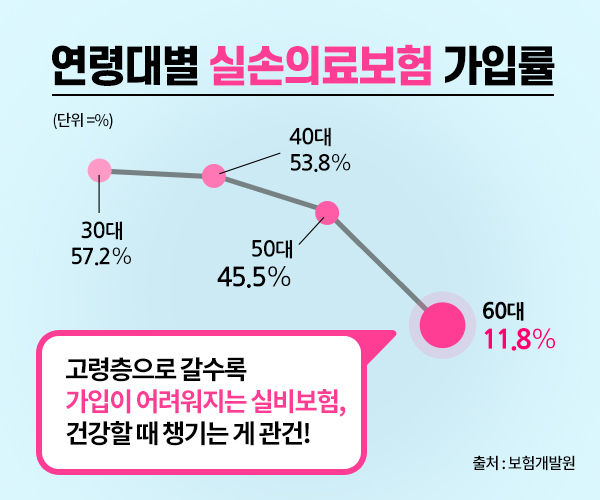

Actual expenses insurance, dental insurance If you still need health, prepare ahead of time and get covered properly.

2019-09-24 00:13:12

Custom design on insurance comparison site

After you go to the hospital, you can claim the actual cost of hospital treatment to receive a certain amount of insurance is the actual cost insurance.

Since the actual cost insurance was revised as a single loss loss insurance in April 2018, it has been possible to cover hospital expenses with a small premium.

In the past, actual cost insurance included a special contract of cancer insurance, driver's insurance, and hospital admission fee insurance, and composed the actual cost insurance as a comprehensive type.

Since the actual premium has been burdensome, people who have put off their insurance coverage are also finding a lot of actual insurance.

The actual cost insurance rider was divided into three categories.

In general, if you do not have actual insurance, it includes expensive treatments.

Manual therapy, extracorporeal shock wave therapy, proliferation therapy / non-administration injection / MRI, MRA.

You can join as one of these three riders.

However, most people say they sign up for all the riders for broader coverage.

It is not necessary to calculate premiums before signing up, since the actual premiums do not suddenly increase dramatically even if you have signed up for all the special riders.

The actual cost insurance comparison site (http://silbi-supermarket.com/?inType=RC19092401) provides more specialized information related to actual cost insurance such as actual cost insurance direct, actual cost insurance rankings, and actual cost insurance.

The actual cost insurance is replaced with the single loss loss insurance and the actual cost insurance is the same for any insurance company.

However, premiums may vary depending on the person, so it is advantageous to get a real cost insurance quote from two or three insurance companies.

In addition, the sick-loss insurance, which is available for those with medical history, was also released.

Even if you have had a history of surgery in the past, even if you are taking blood pressure medicine, you can buy it.

You can also check the information on the casualty loss insurance through the actual cost insurance comparison site.

Hospital expenses can be covered by the actual cost insurance, except for dentistry.

Moreover, dentists have a high proportion of non-paid items, which is expensive when treated once.

That's why more people are looking for dental insurance to protect their dental health, which can't be replaced by actual insurance.

Dental insurance is basically divided into frequent preservation treatment and expensive prosthetic treatment.

Also, there are two types of diagnostic and non-diagnostic tooth insurance products, so you can choose the right one for you.

Since dental insurance products are being introduced more recently, it is important to choose the right one for you.

Through the dental insurance comparison site (http://www.dental-bohum114.co.kr/?inType=RC19092405), it is possible to enroll in dental insurance, dental insurance implants, dental insurance immunity period, dental insurance recommendation products, and childcare insurance.

All can be seen.

If you have dental insurance, there is a period of indemnity and reduction based on the date of coverage.

The period of indemnity is a period in which you cannot be covered for a certain period even if you have dental insurance. The period varies from 3 months to 1 year depending on the product.

The reduction period means that you will receive compensation but receive some deduction.

The reduction period can usually be applied up to two years after joining, so it is necessary to check the difference by product and join.

Most dental insurance usually lasts 90 days.

Reduction periods often cover only 50% of the amount of coverage for one or two years for items such as implants, dentures and bridges.

No matter what type of insurance you have, it is best for you to compare and decide at least two or three insurance products before signing up.

Also, if you have a past medical history, you may be restricted from enrollment. Therefore, it is a good idea to check the insurance to redesign the insurance, such as the past medical history or insurance history.

Livestock Newspaper, CHUKSANNEWS

![[SBS Judge from Hell] 4th teaser, Park Shin-hye](https://kroamer.com/upload/trending/thumb-1oA1726190224411_600x780.jpg)

![[SBS The Story of That Day] A good son sentenced to 100 years in prison](https://kroamer.com/upload/trending/thumb-loI1726126533731_600x750.jpg)